When it comes to investing in the markets, the terms bull and bear market are used to describe how stock markets are doing in general.

Simply put, are they going up or are they going down?

At the same time, because the market is determined by investors’ attitudes, these terms also denote how investors feel about the market and the ensuing trends.

Driving up

A bull market refers to a market that is on the rise. It is typified by a sustained increase in price, for example in equity markets in the prices of companies’ shares. In such times, investors often have faith that the uptrend will continue over the long term.

Typically, in this scenario, the country’s economy is strong and employment levels are high.

Dipping down

By contrast, a bear market is one that is in decline, typically having fallen 20% or more from recent highs. Share prices are continuously dropping, resulting in a downward trend that investors believe will continue, which, in turn, perpetuates the downward spiral.

During a bear market, the economy will typically slow down and unemployment will rise as companies begin laying off workers.

How does this affect investor behaviour?

Because the market performance is impacted and determined by how individuals perceive that performance, investor psychology and sentiment affect whether the market will rise or fall. Stock market performance and investor psychology are mutually dependent. In a bull market, investors willingly participate in the hope of obtaining a profit.

During a bear market, market sentiment is negative as investors are beginning to move their money out of equities and into fixed-income securities, as they wait for a positive move in the stock market. This is not always the best move – following the crowd is not always in our best interest.

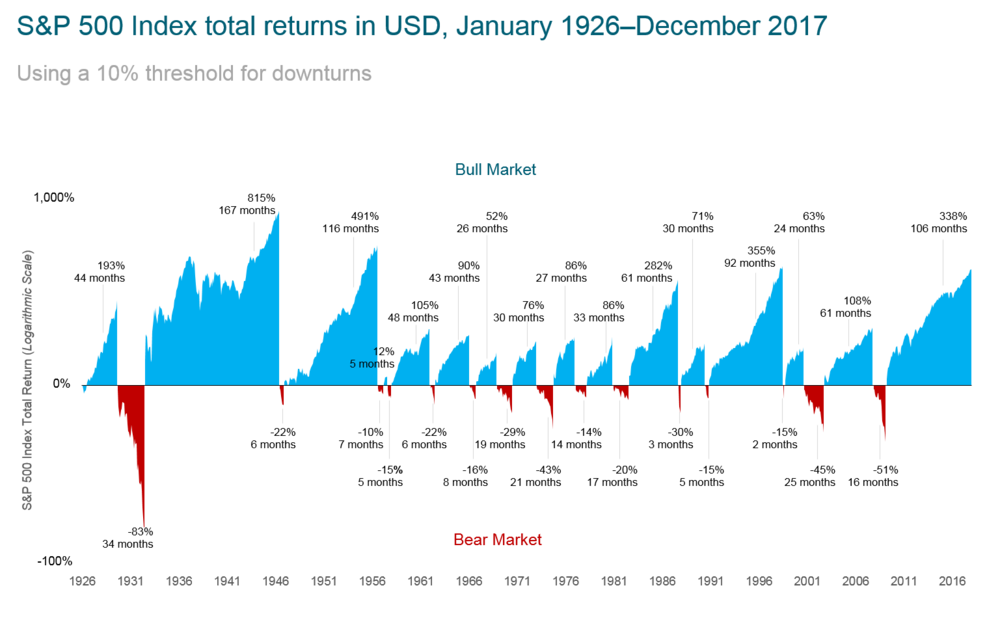

For those who are able to ride the market out, in theory, will benefit in the long run. The graph above shows us that in the last 90 years, the markets have grown more than they have fallen.

How does this affect the economy?

Because the businesses whose stocks are trading on the exchanges are participants in the greater economy, the stock market and the economy are strongly linked.

A bear market is associated with a weak economy as most businesses are unable to record huge profits because consumers are not spending nearly enough. This decline in profits, of course, directly affects the way the market values stocks.

In a bull market, the reverse occurs, as people have more money to spend and are willing to spend it, which, in turn, drives and strengthens the economy.

The Bottom Line

Both bear and bull markets will have a large influence on your investments, so it’s a good idea to take some time to determine what the market is doing when making an investment decision. Having the input from your financial adviser is crucial at this point – but neither market situation is better or worse than the other as both have opportunities and threats to your investment potential.

Remember that over the long term, the stock market has always posted a positive return.