Preparing your children for their financial future is one of the greatest gifts you can give them. For many parents, talking about money can be an uncomfortable subject and discussing finances with your children can feel both personal and scary, but they need to learn if they are to make wise decisions concerning their own finances. It’s best to start teaching these lessons early on in life, if you think about teaching manners or language, it […]

Continue readingCategory: Budget

Drawing up a Budget – Useful Tips

Nowadays, making a transaction can feel somewhat unreal. Just a swipe and a glance at the number displayed on a digital screen. Whilst this seems easy and practical, it poses a big problem that is too-often overlooked. When we stop dealing with physical coins and notes – a mental disconnect occurs between the digital numbers and what they actually mean to you in terms of how much money you have just spent, and how much you […]

Continue readingCommon financial mistakes in your thirties

Saving in your thirties becomes increasingly difficult as your financial responsibilities increase. However, sound financial decisions during this phase of life can have profound benefits at a later stage. Here are some common financial mistakes to avoid: The first is failing to draw up a budget. A proper budget is the starting point of all financial discipline and should be physically written down for later reference. Include your partner in this process as it is important […]

Continue readingFood costs eating through our pockets

Certain provinces have been struggling to keep up with the skyrocketing cost of food. Current data points to an agriculture industry that is struggling, mainly due to the diminished buying power of the rand and a prolonged drought.November 2015 saw the worst drought in South Africa in 23 years. During this time Stats SA released figures showing three consecutive quarters of steep decline in agricultural activity, forcing South Africa to import maize to make up for […]

Continue readingSurviving the weak Rand

South Africa’s weakened Rand is bound to have a negative rippling effect on our economy. The cost of food, electricity, water and imported goods are all set to rise. Now is as best a time as any to take secure control of your finances.Budget According to the National Credit Regulator (NCR), as at June 2015 a shocking 11 million out of more than 23 million credit active consumers had impaired credit records or had failed to […]

Continue readingBack to school budgeting

During this time of the year most of our budgets are understandably depleted, with schools going back in two weeks, we should be mindful of back-to-school expenses that are around the corner.This also affords a great opportunity to chat with your kids about the costs associated with their schooling needs. Involving your children not only helps them understand how much time and effort you put into shopping for them, but it sets them up with good […]

Continue readingTEACHING YOUR CHILDREN TO WORK WITH MONEY

Every parent wants the best for their children, and the best we can give them is a sure footing in life. One of these areas is intrinsically linked to how they will perceive value in others, value in themselves and the value of things around them. It is hard for children to understand the concept of value for money when they have not worked to earn the money for themselves. When a younger child goes shopping […]

Continue readingBUDGET 2015 – HERE’S WHAT YOU NEED TO KNOW…

“Today’s budget is constrained by the need to consolidate our public finances, in the context of slower growth and rising debt.” said Minister of Finance, Nhlanhla Nene. Giving the budget speech was a far from enviable job in light of the huge government spending deficit that needs to be recovered. The speech was a short 26 pages long, but what every person on the street wants to know is: How will this affect me? Remember, the […]

Continue reading10 TIPS FOR FINANCIAL PLANNING

Do you want to begin your 2015 financial year on a good note? Then what better time to review your financial plan! A financial plan provides you with the financial security to overcome unforeseen events and map out a financial future for yourself. When creating a financial plan you need to identify key achievable goals that can advance your financial situation. Here are 10 tips for improving a financial plan: You need to have a clear […]

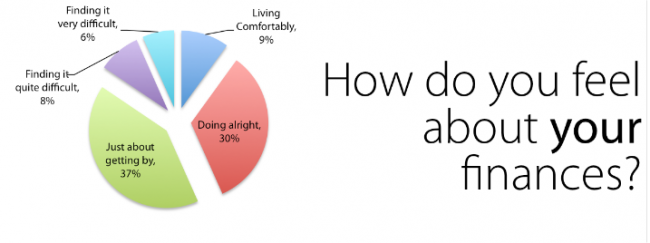

Continue readingHOW DOES YOUR BUDGET SHAPE UP IN SA?

Whilst I always view clients within their unique situation and tailor their financial plans to their needs and goals, part of knowing how to guide them involves an awareness of current trends and the economic landscape. One of these measures is found in the Old Mutual Savings & Investment Monitor that was published in early August 2014. Essentially, this survey asks the question: ‘Are you financially comfortable?’ They looked at households from metropolitan areas that were […]

Continue reading